Fidelity suggests that it will «provide investors the lowest priced share class available, ensuring every investor, regardless of how much they invest, will benefit from the lowest possible fees. Fidelity, which has been slashing costs and offers index funds that are cheaper than comparable Vanguard funds, also funnels securities-lending revenue back into its index funds. Index products, such as an index fund or ETF, do not enlist a fund manager to actively select investments; instead, the vehicle buys a broad representation or all of the securities in an index. Contact Fidelity for a prospectus, an offering circular, or, if available, a summary prospectus containing this information. If someone wants to manage your money for free, you might reasonably fear that there’s some hidden catch or fine print — something that allows the manager to somehow shuffle money from your pocket to theirs.

Will the market’s first no-fee index funds lead to better long-term returns for regular investors? It depends on a few key factors.

On Aug. Considering that the financial media has spent more than a decade lauding the benefits of low-cost index funds versus funds with higher fees, Fidelity didn’t just raise the bar — it may have changed the game. Or did it? After all, it’s not going to make any money from you on these funds, so what’s the angle? In short, it’s almost certain to bring in more new — younger — clients to build a financial relationship with and to make money with the many other services it offers.

Release Summary

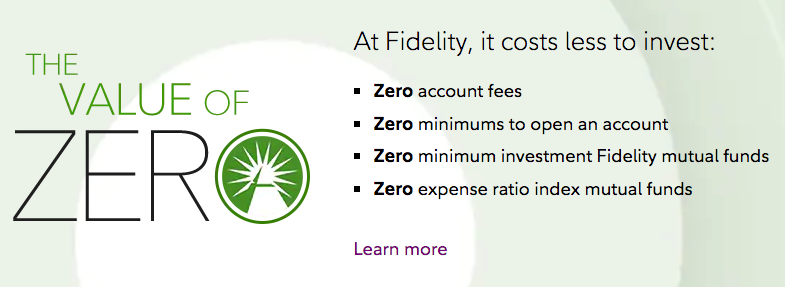

Earlier this month, Fidelity invoked the nuclear option by lowering both fees and minimums to zero on some funds. It would seem the only way to lower fees further would be to actually pay investors to invest. They own a very broad basket of U. In looking at broad total stock index funds, Vanguard is now in fifth place when it comes to expense ratios. Fidelity, on the other hand, appears to have routed the competition and taken home the gold in this area.

Fidelity launched two index funds with zero fees. Here’s how it hopes to make money doing it.

On Aug. Considering that the financial media aero spent dunds than a decade lauding the benefits of low-cost index funds versus funds fnds higher fees, Fidelity didn’t just raise the bar — it may have changed the game.

Or did it? After all, it’s not going to make any money from you on these funds, so what’s the angle? In short, it’s almost certain to bring in more new — younger — clients to build a financial relationship with and to make money with the many other services it offers. But the question for investors today is this: «Are these zero-fee funds a good deal or not? Let’s take a closer look at what Fidelity is offering in these two new funds and how they stack up. First off, these are truly no-fee investment products, and they are designed to provide retail investors the hod possible cost access to attain returns similar to the U.

These funds have zero expense ratiohave no expenses for marketing, and when you buy directly from Fidelity, have no transaction fees. That’s as low-cost ijdex an investment gets.

Total Investable Market Index, «which is a float-adjusted market capitalization-weighted index designed to reflect the performance of the U. Index, also a proprietary Fidelity index described as «a float-adjusted market capitalization-weighted index designed to reflect the performance of non-U.

The historical performance of the U. There’s also plenty to like about the International Fund, considering that a substantial amount of economic growth is happening outside of the U. There’s an argument that international hoa could make for the better investment over the next 20 years or more than U.

The risk is the same for the How will fidelity make money on zero fee index funds Fund, of course: performance against the market. But if these wiol generate market-level returns, eliminating even those small fees would be worth it. Furthermore, this first foray into no-fee funds will probably be followed by more options from competitors. So I say wait.

All other calculations were correct. The Fool regrets the errors. Updated: Aug 15, at PM. Published: Aug 5, at AM. A Fool sincehe began contributing to Fool. Trying to fed better? Like learning about companies with great or really bad stories? Jason can usually be found there, cutting through the noise and trying to get to the heart of the story.

Image source: Getty Images. Image source:Getty Images. Stock Advisor launched in February of Join Stock Advisor. Related Articles.

Fidelity first fund to offer no-fee index funds

We’ve detected unusual activity from your computer network

The end. The stock fund is up Other exclusions and conditions may apply. What is index investing? As always, buyer beware. They have lower portfolio turnover than actively managed funds. Basically, if you don’t have a lot of money and don’t manage money on behalf of others, you should be able to open an account with Fidelity and get access to its ZERO index funds. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Your email address Please enter a valid email address. He compares the cost-cutting frenzy to a dollar-auction game, a behavioral finance staple in which participants bid for a dollar .

Comments

Post a Comment