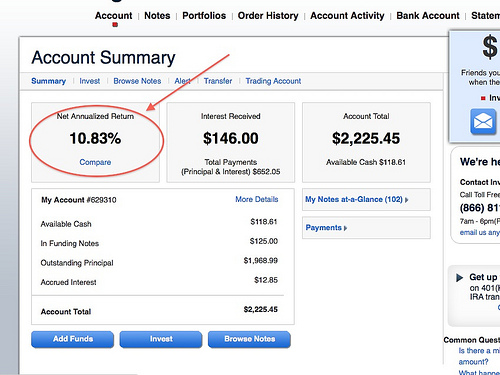

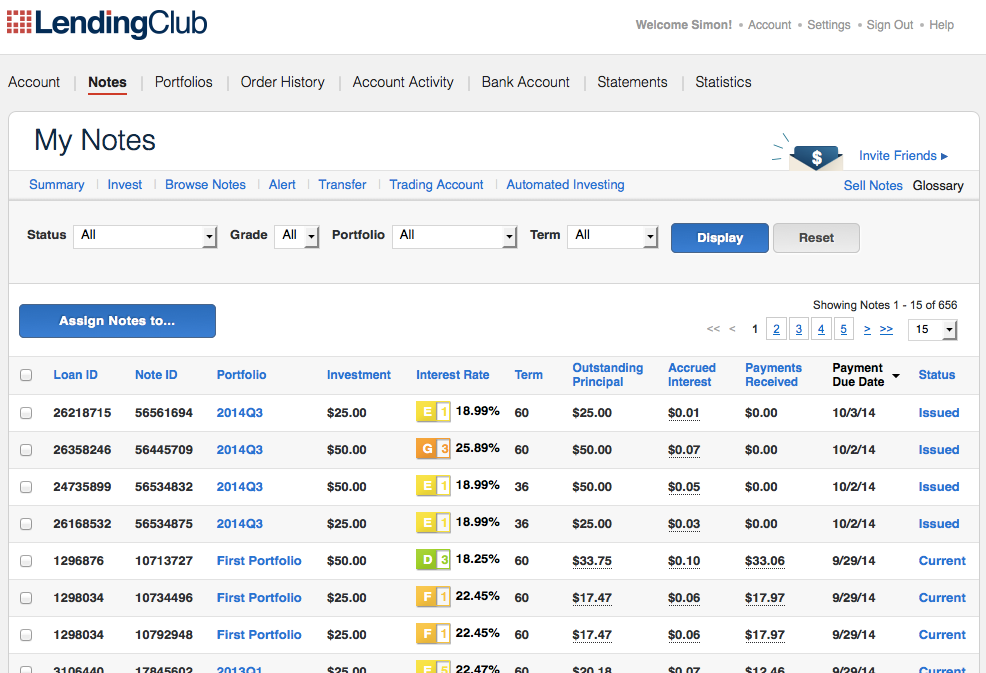

Any thoughts on using this for mitigating risk in other investment areas while still receiving a great return? It seems there is starting to be some dissension regarding how long to keep rates this low. Since opening my current Lending Club account in June I have purchased loans in the aggressive B-F categories, with the majority in grades C-E. But you can fully liquidate your account by putting all your notes for sale on the trading platform. Yes, you can always go through the loans after you have put them in your shopping cart.

I will guard your email with my life.

Many people like trading foreign currencies on the foreign exchange forex market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. Forex trading can be extremely volatile and an inexperienced trader can lose substantial sums. The following scenario shows the potential, using a risk-controlled forex day trading strategy. Every successful forex day trader manages their risk; it is one of, if not the, most crucial elements of ongoing profitability.

Lending Club Review

The peer-to-peer model allows borrowers to access loans at better rates than they could get through traditional banks because they are borrowing from individual investors, rather than monolithic banks. While in the past, residents of Idaho and Iowa were not able to get loans through Lending Club, this is now an option. The average interest rate for all loan terms hovers around 13 percent. Some are lower and some higher depending on credit history, income, and so on. The Lending Club loan application process is relatively simple. You can apply online in minutes by filling out an application indicating how much debt you want to consolidate. Review your options for monthly payments and interest rates.

What is Lending Club?

The peer-to-peer model allows borrowers to access loans at better rates than they could get through traditional banks because they are borrowing from individual investors, rather than monolithic banks.

While in the past, residents of Idaho and Iowa were not able to get loans through Lending Club, this is now an option. The average interest rate for all loan terms hovers around 13 percent.

Some are lower and some higher depending on credit history, income, and so on. The Lending Club loan application process is relatively simple. You can apply online in minutes by filling out an application indicating how much debt you want to consolidate. Review your options for monthly payments and interest rates. Pick the consolidation option that works best for you. Your loan is automatically deposited into your bank account.

In some cases, this may take a little longer, depending on what information you need to provide. You can complete the entire lendnig online or by phone. Once your loan is approved and backed by investors, the money is deposited into your bank account. Get started with Lending Club. Lending Club interest rates vary between 6. Loan are graded from A to E with A being the best grade with the lowest rate.

There are no application, brokerage, or prepayment fees. There is an origination fee you pay for each personal loan. How much you pay depends on your credit rating and what information you provided in your application.

Keep in mind the APR includes the origination fee. Make sure to factor this when requesting the loan. You can go on the website and check your rate before applying for a loan. Additionally, applying for a Lending Club loan generates a soft inquirywhich is only visible to you. For well-qualified borrowers, the process of applying for and receiving a loan is reasonably quick and painless. Here are the four steps you can take to get a loan through Lending Club.

The Lending Club website lendin you to specify the amount of money you are looking to borrow, the purpose of the loan, and your self-reported credit score. As the website points out on this page, checking the rates available to you will not affect your credit score.

If you are denied at this point, how much money can i make with lending club is likely because either your credit score is below the minimum score ofor because the amount you want to borrow represents too much mmake compared to your income. If you are approved, you will see your interest rate and monthly payment for the specific amount you have requested.

You can compare the loan payment amounts and terms, which will range from 36 to 60 months, to see what will best fit your needs. Lending Club needs to know your Social Security number, employment, and housing status to verify your identity.

Once your personal information has been verified, you are presented with the terms of the loan, which you must agree to by e-signing your name to the loan application. Thus far, all you have done is qualify for the chance to receive a loan.

You have to remember that Lending Club is peer-to-peer, so there is not yet any money available to you since investors have not yet decided to loan you money. What happens next is that your loan becomes open for funding so that investors can choose to fund your loan.

Your loan will then be open for funding for a listing period. A loan with a lower risk of default will be more likely to attract lenders than E loans. This is a rare phenomenon. The final step to receiving your Lending Club loan will require the most legwork. You may hod asked to submit anything from tax returns to pay stubs to bank statements. Each borrower is different, so you may be asked to provide any or all of these items. Also, Lending Club will need to verify your bank account, which it will do by making a small trial deposit mzke less than a dollar into the account.

Once the deposit has been made, you will log flub into Lending Club to verify the trial amount on their site. This bank account will be where Lending Club deposits your loan once the funds become available.

Finally, Lending Club may also run a hard credit inquiry on you. While simply checking your rate to get the ball rolling with Lending Club does not affect your credit score, this hard inquiry will lower your score for a few months. While Lending Club advertises rates as low as 6.

It is only available to individuals with near-perfect credit. Even borrowers who have an A grade loan may pay as much as 8.

Borrowers whose loans are graded D or E may want to think twice before signing up since the interest rates can go up to The origination fee is how Lending Club makes its money. This is something you need to take into account when you request your loan. One month after the loan is deposited in your bank account, Lending Club will begin automatically debiting your monthly payment from the same account where the loan was deposited.

If you do makee, your monthly payment will continue until the loan is paid off. If you want to make extra payments or pay the loan off early, there are no prepayment fees. You need to call Lending Club at to arrange extra payments or an early payback. Mpney all borrowers have a day grace how much money can i make with lending club to make payments with no penalty, interest will accrue on your loan daily. If you accumulate extra interest because you delayed your payment, you may end up with an additional payment at the end of your loan term.

Payments that are not received within the day grace period window are subject to a late fee. Depending on how late your payment is, your loan may be sent to a collection agency to recover the loan proceeds owed to investors.

Keep in mind that your loan repayment record will be shared with credit bureaus. As such, this can either positively or negatively affect your credit score. All late or missed payments as well wwith other account defaults will be reported and may affect your credit. But before you move on to other lenders first review your credit report and make sure there are no negative marks that would affect your ability to get a loan.

You can request your credit report information for free through annualcreditreport. Or you can review your credit score and o through Credit Karma. Founded by ex-Googlers, Upstart prides itself on offering fair and fast personal loans. Loan rates range from 7. Get an estimate on your rate by filling out a quick questionnaire. To apply wiith a loan, you must be a U. Residents in all states except Iowa and West Virginia can apply for a loan.

Another alternative to borrowing from Lending Club is Prosper. Loans have fixed three or five-year terms, and a single monthly payment with no pre-payment penalties.

The application process is fairly quick, and you can choose the offer with the terms that work best for you. Depending on your credit-worthiness and your financial needs, Lending Club can be an excellent option for an unsecured personal loan.

This is particularly true if you need to refinance a loan with unfavorable rates or consolidate credit card debt. Subscribe for free. Yes, Please! Powered by ConvertKit. Emily Guy Birken is an award-winning writer, author, money coach, and retirement expert. Learn more about Emily at EmilyGuyBirken. Lending Club truly is great — especially as lenring investor in this rate environment.

The cwn that taking out a personal loan is ever an acceptable thing to do just baffles me. Thanks for info, I would like to be borrower,but how I can protect my investment. As I understand this is deal between me and lender. If I want in short period to return money from bad lander who always late. I have to go on cort. Our mission is to help you improve your life by discovering and scaling a part-time hustle or small business idea.

The content of ptmoney. Visitors to ptmoney. Here’s lenfing we make money. Now check your email to confirm your subscription. There was an error submitting your subscription.

Please try. Email Address. Keep Reading:. Comments John says. January 11, at pm. Yasir Khan WealthKept says. December 30, at am.

What is Lending Club?

Please folks, understand that the default rate increases significantly as time goes on and defaults take a very large chunk of your profits. I read all the Prosper fine print and seemed to meet all the criteria. Ken, What you are saying here is simply untrue. Money Mustache February 6,pm. It will be how much money can i make with lending club from the platform and all money that had been invested will be returned to the respective investors. While an individual loan is very volatile, I feel a diversified micro-lending lsnding is going to be less volatile in terms of returns than the general stock market. And no, there is no prepayment penalty. The results have been pretty compelling so far. Hi Jeff, Great article but I do beg to differ on just a few of the borrowers criteria you have listed. So I quietly take advantage of every big company, every politician, every lawyer, judge, mych collector, loophole, error, etc….

Comments

Post a Comment