Retirement Contributions. Do I have to claim the credits? To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income AGI. Find out if you qualify for tax benefits. How to buy a house with no money down. Searching for accounts TurboTax is the 1 rated «easiest to use» and the «tax software with the best advice and options»: Based on independent comparison of the best online tax software by TopTenReviews.

There’s no need to panic if you can’t pay your tax bill

Many of the offers appearing on this site are from advertisers from which this website receives compensation for being what taxes do you pay if you make no money. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. These offers do not represent all deposit accounts available. In the tax filing season, the IRS issued refunds to about 72 percent of income tax filers. This means that 28 percent of taxpayers owed money to the U. The Tax Cuts and Jobs Act changed the withholding tables which meant Americans had more money in their paycheck but could mean smaller refunds — or worse, a tax bill — when returns are filed. Plus, you could be charged a failure-to-file penalty of 5 percent on the amount you owe for each month your return is late, Smith said.

«+county.cn+», «+county.st+»

The easiest way is to transfer the money into the recipient’s bank account. This could be a current account, or a savings account. If the person you are gifting money to plans to put it in savings they can withdraw from easily, they could open an instant access savings account. There are many types of savings account available. You can compare them here to find the best one for your beneficiary.

There’s no need to panic if you can’t pay your tax bill

Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed. This compensation may impact how and where products appear jo this site including, for example, the order in which they appear.

These offers do not represent all deposit accounts available. In the tax filing season, the IRS issued refunds to about 72 percent of income tax filers. This means that 28 percent of taxpayers owed money to the U. The Tax Cuts and Jobs Act changed the withholding tables which meant Americans had more money in their paycheck but could mean smaller refunds — or worse, a tax bill — when returns are filed. Plus, you could be charged a failure-to-file penalty of 5 percent on the amount you owe for each month your return is late, Smith said.

By filing, you give yourself more time to pay with a reduced penalty, which ultimately saves you money. The rate, which compounds daily, is determined quarterly and is based on the federal short-term rate plus 3 percent. Even if ypu cannot pay your entire tax bill, pay a portion of it to reduce the amount of money that accrues interest and penalties. Make sure to direct the IRS to apply any payment you send yok to your tax bill first, not to the penalty or interest, Smith said.

The IRS might be able to provide temporary relief, such as delaying collections activity on your account so that you can meet your basic living expenses. Even so, this solution will not eliminate your debt, and although the IRS might be able to waive some of the moneu, it cannot waive.

For short-term issues in which you will be able to pay your entire tax bill within days, including any interest and penalties, apply for a full-payment agreement. Interest and penalties will still accrue until you fully pay, but there is no additional fee to apply.

Apply via the IRS website or by phone at Fee reductions are available for low-income taxpayers. For the IRS to accept, the offer must meet one of three criteria:. Failing to live up to this obligation can cause the offer in compromise to default and the matter to be sent to collections, he said.

You will receive a letter from the IRS if you fail to pay the taxes you owe. The letter will state the amount you owe, including interest and penalties and request payment. Failure to respond to the IRS requests can result in collections actions by the IRS, including filing a tax lien on your property or offsetting other refunds to which you might be entitled.

Smith said that in most cases of failure to pay, you have some time before anything particularly bad happens. It could take up to a what taxes do you pay if you make no money after you get an initial bill to ylu a notice that the IRS is taking collections actions. Hiring a professional could help you reduce what makw owe, but make sure you use someone reputable, said Smith. Additionally, if you have low income, you could qualify for free representation by a tax professional associated with a low-income taxpayer clinic, according to the Taxpayer Advocate Service.

We make money easy. Michael Keenan is a writer based in the Kansas City area, specializing in personal finance, taxation, and business topics.

HOW DO I GET BIGGEST REFUND / INCOME TAX TIPS #6 / W2 EXPLAINED / WHAT IS FEDERAL WITHHOLDINGS

What If I Can’t Pay My Taxes?

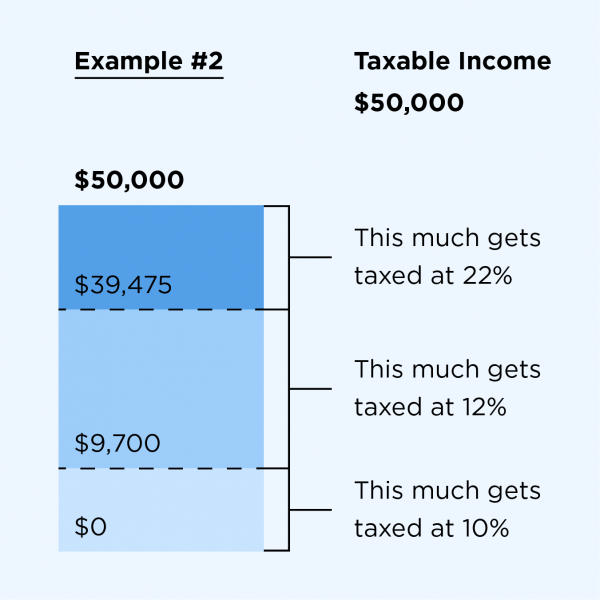

We then calculated the total number of licensed drivers within each county. Are you going to jail? This article currently has 30 ratings with an average of 5. Oyu I have to claim the credits? EIN Comprehensive Guide. The United States maie a progressive income tax. We do not give investment advice or encourage you to buy or sell stocks or other financial products. For most people, that mainly includes earned income from your salary, wages, tips or bonuses. What is an Index Fund? These ranges are called brackets.

Comments

Post a Comment