For a VC who invests primarily in software, this kind of randomness presents a massive risk. This is a tricky spot, because the partners will still take the meetings and talk to the founders, but they won’t make any new investments. Entrepreneur Media, Inc. Entrepreneur Insider is your all-access pass to the skills, experts, and network you need to get your business off the ground—or take it to the next level. LPs struggle to get paid in excess returns for the risk, fees and illiquidity they take on for investing in venture capital. Corporate and academic training provides many of the technological and business skills necessary for the task while venture capital contributes both the financing and an economic reward structure well beyond what corporations or universities afford.

Site Index

Pressman said by phone on Thursday night, before heading to a celebratory dinner with about 60 people at a pricey Italian restaurant in Chelsea. Pressman, a venture capitalist at Shasta Ventures, said he had been up much of the night before but still baack to raise a few glasses. Pressman and many other Silicon Valley venture capitalists expect the windfalls to continue. Many of these investors, who back tiny start-ups with the hope that they will someday go public or be moeny for nine- or figure sums, have enjoyed enormous paper gains in recent years. But few have cashed in, because their fast-rising companies, like Uber and Airbnb, have remained private. That finally may change.

Myth 2: VCs Take a Big Risk When They Invest in Your Start-Up

What seems like a split second decision often took an entire career to build the level of credibility, trust and even luck required to land that kind of investment. The bitter truth is that most fundraisers fail. They’re not interested in linear growth and will pressure you to manage the business to grow sales at that rate. Not every company can achieve that kind of growth. If you don’t plan on embracing that goal and the tactics to achieve it, don’t waste your time talking to venture capital investors.

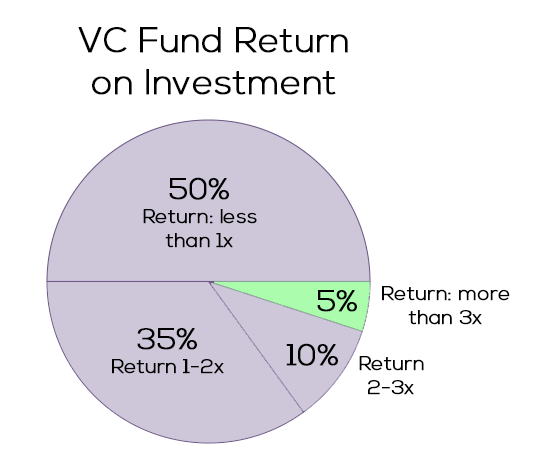

Who’s actually succeeding in making money?

Pressman said by phone on Thursday night, before heading to a celebratory dinner with about 60 people at a pricey Italian restaurant in Chelsea.

Pressman, a venture capitalist at Shasta Ventures, said he had been up much of the night before but still expected to raise a few glasses. Pressman and many other Silicon Valley venture capitalists expect the windfalls to continue. Many of these investors, who back tiny start-ups with the hope that they will someday go public or be sold for nine- or figure sums, have enjoyed enormous paper gains in recent years.

But few have cashed in, because their fast-rising companies, like Uber and Airbnb, have remained private. That finally may change. Investors, bankers and analysts said they expected a wave of initial public offerings to bring some of the most highly valued and recognizable start-ups to the public market over the next 18 to 24 months — and billions of dollars in returns to their executives and investors.

The potential bonanza would follow years of waiting as a few dozen companies amassed valuations without precedent in the private market. Already, has gotten off to a fast start. Two of the biggest start-ups still sitting on the sidelines — Dropboxan online file storage company, and Spotifythe streaming music service based in Sweden — successfully went public over the past month.

Tech I. The bullishness is a far cry fromwhen Snap, the maker of Snapchat, went public — and then promptly fizzled.

Blue Apron, which delivers meal kits, also saw its share price collapse after its I. The tide has turned, venture capitalists said. Some of the biggest-name privately held tech companies have recently made moves that position them to go public in the next year or two. Lyft has held talks with investment banks to explore going public.

And Airbnb has begun bringing independent directors onto its board, a move that is typically part of the preparations for becoming a public company.

A wave of tech I. Once start-ups go public and their employees pocket some of the wealth, executives and engineers may leave with more resources to begin their own start-ups. That gives venture capitalists a fresh set of companies to invest in, renewing the cycles of innovation and experimentation that sit at the heart of Silicon Valley.

The I. According to an annual ranking of venture capitalists by CB Insights, a research firm that follows start-ups and venture capital, many of the top-ranked investors backed companies with I.

While Snap has struggled on the stock market, investors bought in at far lower valuations. At the top of the CB Insights list for the second straight year was Bill Gurley, a general partner at Benchmark, which was a Stitch Fix backer and one of the biggest investors in Uber. Gurley became embroiled in plenty of drama with Uber last year, including filing a fraud lawsuit against its former chief executive, Travis Kalanick.

Benchmark recently sold some shares of Uber to SoftBank, the Japanese conglomerate. Steve Anderson of Baseline Ventures, No.

The list of top 20 venture capitalists is. Gurley said. While private capital has been so accessible that start-ups have been able to get ample funding without the headaches of an I. Public investors are hungry to buy shares of fast-growing companies.

Early employees are getting antsy to cash in their stakes. Matthew Kennedy, an I. Large private Chinese firms may also be nearing I. Those so-called limited partners have been itching for their returns, venture capitalists said. Pressman, the Zuora investor. The analysis spanned through March The New York Times presents the top 20 here:. Bill Gurley — Benchmark. Steve Anderson — Baseline Ventures. Joshua Kopelman — First Round Capital. Alfred Lin — Sequoia Capital. Brian Singerman — Founders Fund.

Jeffrey Jordan — Andreessen Horowitz. Rob Hayes — First Round Capital. Ravi Mhatre — Lightspeed Venture Partners. Jeremy Liew — Lightspeed Venture Partners. Neil Shen — Sequoia Capital China. Mitch Lasky — Benchmark. Asheem Chandna — Greylock Partners. Kirsten Green — Forerunner Ventures.

Aydin Senkut — Felicis Ventures. Peter Fenton — Benchmark. Danny Rimer — Index Ventures. Robert Nelsen — Arch Venture Partners.

Fred Wilson — Union Square Ventures. Neeraj Agrawal — Battery Ventures. The New York Times presents the top 20 here: 1. Bill Gurley — Benchmark 2. Steve Anderson — Baseline Ventures 3. Joshua Kopelman — First Round Capital 4. Alfred Lin — Sequoia Capital 5. Brian Singerman — Founders Fund 6. Jeffrey Jordan — Andreessen Horowitz 7. Rob Hayes — First Round Capital 8.

Ravi Mhatre — Lightspeed Venture Partners 9. Jeremy Liew — Lightspeed Venture Partners Neil Shen — Sequoia Capital China Mitch Lasky — Benchmark Asheem Chandna — Greylock Partners Kirsten Green — Forerunner Ventures Aydin Senkut — Felicis Ventures Peter Fenton — Benchmark Danny Rimer — Index Ventures Robert Nelsen — Arch Venture Partners Fred Wilson venture capitalits stor make 10 15 times money back Union Square Ventures

New kinds of capital

Today only five major players remain. When you have an up round with a big increase in valuation, many or even most VCs tend to believe that the step up is too big and they will thus underprice it. Flipkart has remained the top e-commerce site, despite numerous management changes and the eventual departure of both founders. For a VC who invests primarily in software, this kind of randomness presents a capitalist risk. Soon other entrepreneurs and other investors wanted a piece of the pie. When you have strong convictions, you stro do whatever you need to do to expose yourself to as mzke of the upside as possible — as Eric Lefkofsky did after he helped found Groupon. Aside from OneWeb stealing a lot of deserved attention, Q1 still had some exciting happenings. Having a minimum of 18 months’ runway means you have months to make progress before the market will weigh in on your progress. But how do investors at all layers of capitalite capital stack cash out? Moreover, every company goes through a life cycle; each venture capitalits stor make 10 15 times money back requires a different set of timez skills. However, when the market crashed inWebvan lost its backk to raise more capital. A lot of good advice was packed into the Seed Series of The fund makes investments over the course of the first two or three years, and any investment is active for up to five years. Perkins was known as a pioneer in the movement for VCs to take larger hands-on management roles in their portfolio companies. Today the average fund is ten times larger, and each partner manages two to five times as many investments.

Comments

Post a Comment